Candlestick Chart Pattern Shooting Star Finest Magnificent

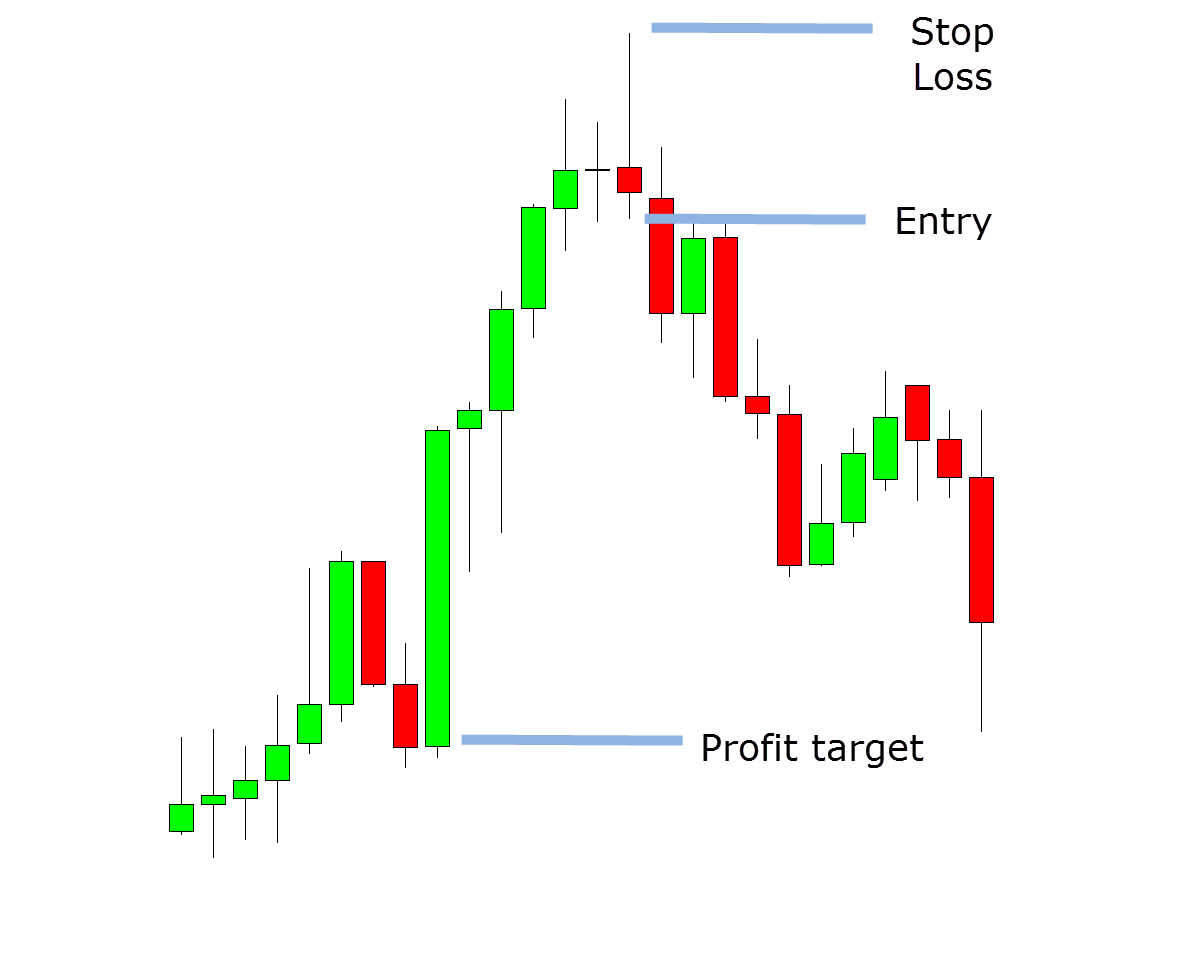

candlestick chart pattern shooting star. They are typically red or black on stock charts. Look for the price below the candle to confirm the bearish direction.

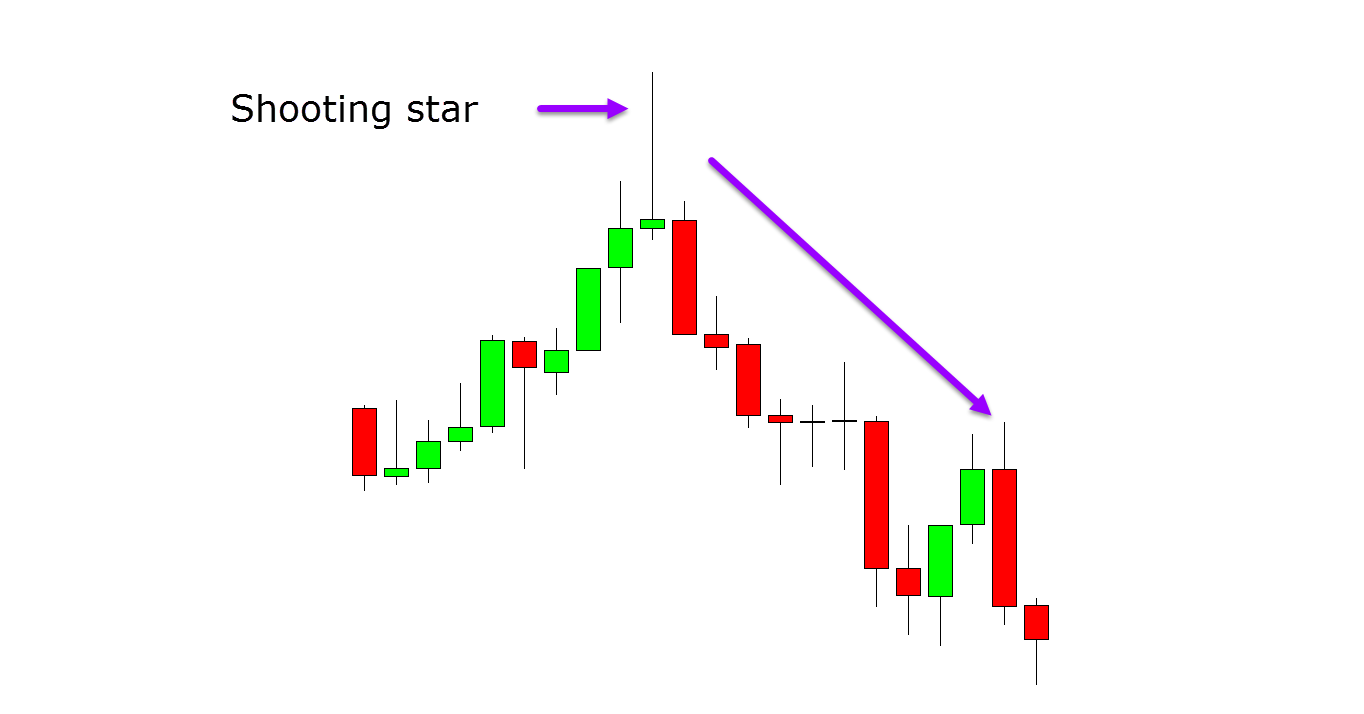

candlestick chart pattern shooting star They are typically red or black on stock charts. A shooting star candlestick pattern occurs when the price of a security increases significantly after opening and then drops rapidly towards the market close to a price level that is close to the opening price. Shooting star patterns are interpreted as a bearish reversal pattern.

You Can Recognize The Shooting Star Candlestick Pattern On The Chart By Looking At.

Learn about what is a shooting star candlestick pattern, formation of shooting star candlestick, bullish and bearish patterns, and. A shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. These patterns look like inverted hammer candlesticks but are near resistance levels.

Shooting Star Candlestick Patterns Mark The End Of An Uptrend And Signal An Upcoming Bearish Trend.

Look for the price below the candle to confirm the bearish direction. The candle has a small body; The wick at the top must be big compared to.

A Shooting Star Candlestick Pattern Occurs When The Price Of A Security Increases Significantly After Opening And Then Drops Rapidly Towards The Market Close To A Price Level That Is Close To The Opening Price.

Shooting star patterns are interpreted as a bearish reversal pattern. How do i identify shooting star candlestick? Understand when to use the shooting star candlestick as a reversal pattern and how to apply it correctly.

Here’s How To Identify The Shooting Star Candlestick Pattern:

They are typically red or black on stock charts. Shooting stars appear in up trends but are a bearish candle.

Leave a Reply